Ronald W. Ragan, in his inaugural address as 40th President of the United States of America, defined the then economic crisis being faced by the US as “an economic affliction of great proportions”. “We suffer from the longest and one of the worst sustained inflations in our national history”, Ragan called it. “For decades we piled deficits upon deficits, mortgaging our future and our children’s future for the temporal convenience of the present. To continue this long trend is to guarantee tremendous social, cultural, political, and economic upheavals”. The mind-illuminating words of Ragan captured what the quintessential Deputy Senate President, Senator Ike Ekweremadu, had in a mind when he called for the review of Nigeria’s “feeding bottle federalism”, where the thirty-six states of the federation congregate in Abuja at the end of the month to suck from the proverbial feeding bottle—crude oil revenue.

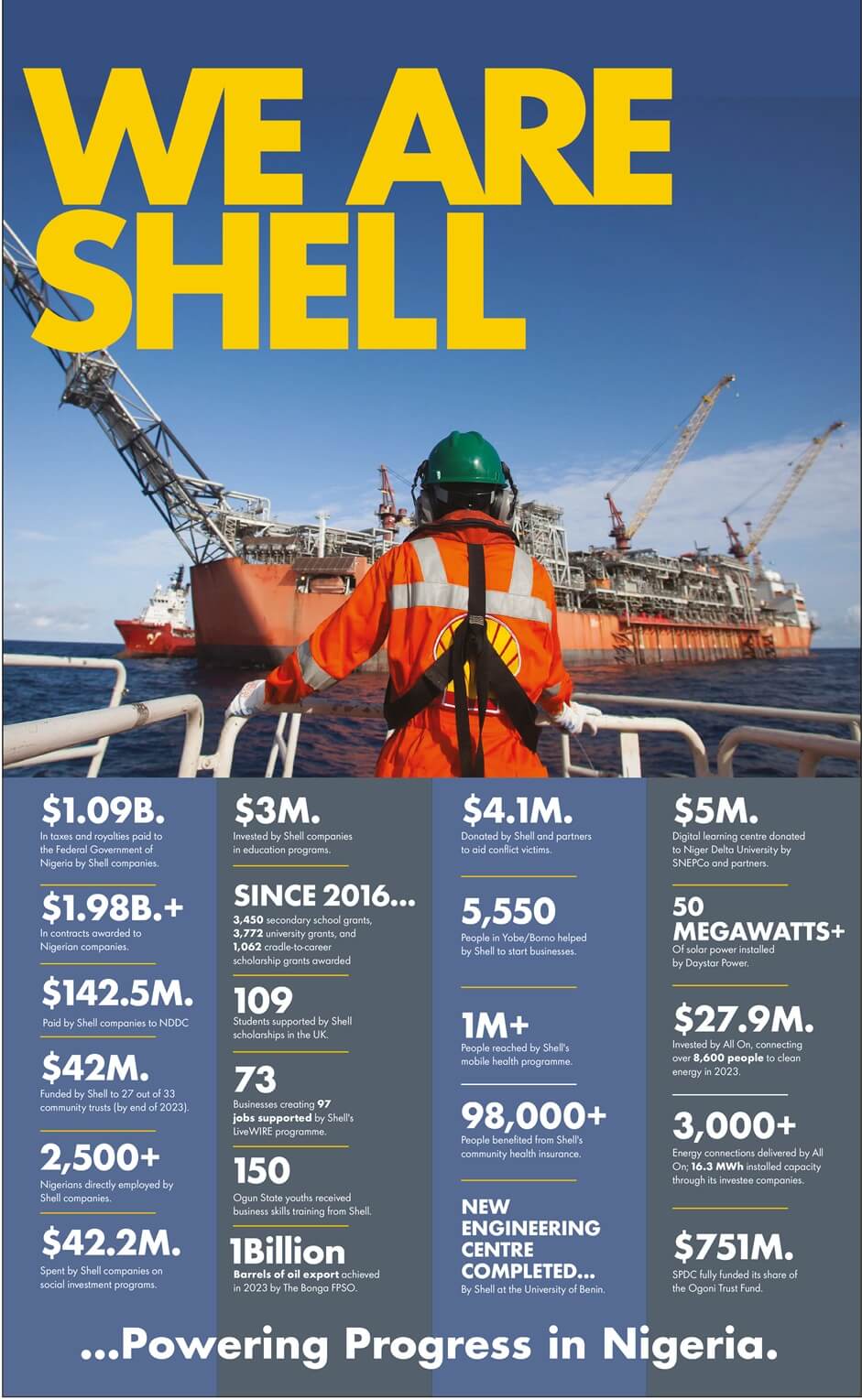

As at the time of writing this article, crude oil price has hit its four-year low record of $72 per barrel, less than 24 hours after the Organization of Petroleum Exporting Countries, OPEC, ended its 166th meeting, with a resolution to keep the production quotas unchanged, oil price dipped further, surpassing a new benchmark proposed by Nigerian government. The Federal Government has proposed a new benchmark of $73 per barrel, from $77.5 approved in the 2014 budget. The latest crash indicates the $73 benchmark may not be realistic, a concern earlier pointed out by the governor of the Central Bank of Nigeria, Godwin Emefiele. Mr. Emefiele, at the end of the Monetary Policy Committee (MPC) meeting in Abuja, described the new oil benchmark as “overly optimistic”, as the decline continues. The Coordinating Minister of the economy, Dr. Okonjo-Iwela, while reacting to the dwindling oil price in the international market said, “our scenario-based approach to managing the impact of the oil price drop is proactive and comprehensive. Even if the price drops to 60 dollars we are ready. Panic is not a strategy. We are managing the situation to keep the economy on a stable sustainable course and we will not listen to those who want us to throw up our hands in despair and give up”, she stressed.

While some pessimists are busy focusing on the negative impact this crash would portend for the nation’s economy, this writer is one person who sees the nose diving of oil price as a blessing in disguise for Nigeria, irrespective of the temporal challenges the economy may experience, crude oil being the major source of foreign exchange. The unexpected fall of crude oil price would not only awaken our politicians from the slumber of complacency to diversify the nation’s economy from oil, and resuscitate non-oil sectors like Agriculture, solid minerals, tourism, textiles and steel industries, etc, to revolutionized the economy, but will exert pressure on Nigeria’s political leadership to restructure the economy by reducing the bogus size of this government. The present political structure as constituted, made up of 36 states plus FCT, 774 LGAs, 36 State Governors, 42 Ministers, 469 National Assembly members, 541 MDAs, etc, is not sustainable. No serious progressive-minded nation spends 74 percent of her annual budget on recurrent expenditure, while devoting only 26 percent of the same budget for capital projects. The Minister of Finance, Dr. Okonjo-Iwela, not too long ago attributed the high recurrent expenditure in the 2014 budget to increasing wage bill of workers and political office holders. This situation has remained a major challenge to the economy, and has led to the reduction in the funds available for capital projects. The present administration worked hard to reduce this ration from 74.4 percent in 2011 to 71.5 percent in 2012 and further to 67.5 percent in 2013, but has risen again to 74 percent in 2014. In addition to high wage bill, there are pension arrears, which needed to be incorporated in budgets in the future. It has become pertinent to strike a balance between a growing wage bill for the public sector and investing more on infrastructure. How can we justify spending a whooping amount of N2.4 trillion annually to service salaries and allowances of civil servants and political office holders, to the detriment of the economy. Do we really need this size of civil service? How many states can survive for three months without oil money from Abuja? Is it possible to run the affairs of this nation with maximum of 12 Ministers, than this present 42 Ministers with their aides being paid from government pursue? Do Nigerians need 469 people as National Assembly members to make laws for us? Can’t we have National Assembly of 120 people, instead of this present 469 people who consume the nation’s N150 billion annually? I can recall vividly that National Assembly members started gunning for the head of the former governor of CBN, Sanusi Lamido, when he made a mindboggling revelation that they were consuming 25 percent of the nation’s budget, which we borrow money to augment its deficits, while a least paid worker in the country earns just 0.13 percent (N18, 000) of a Senator’s salary. Are we not tired of subsidizing corruption and consumption in the name of fuel subsiding? I am a strong advocate for subsidy if they are for production and not consumption, and if they benefit the poor and not middle men and rent-seekers. US government subsidies cotton and Nigeria spends its reserves importing wheat from America and keeping American farmers employed. We use our forex to import petroleum products and keep refineries and jobs open in Europe, while unemployment is ravaging our youths like Ebola. Can we continue progressing in error by virtually importing everything because we have oil in our backyard? Can we remain an import-based economy while boosting as the largest economy in Africa?

The dwindling oil price is not a reason to be afraid or panic, but a golden opportunity to diversify Nigeria’s economy from age-long oil sector; at the same time reduce the recurrent expenditure by trimming down the MDAs from the present 541 to about 168 MDAs as recommended by Stephen Oransaye Committee. As sadly as it may sound, we still give our children this obsolete advice of, “Go to school, get good grades, find a safe secure job, work hard, save money, and when you retire government would take of you”. Even the United States, the second largest world economy, can no longer afford social programs such as social security and Medicare. In the Information Age, the age where job security and a pension for life are not guaranteed, financial education is essential to enable Nigerian youth become self-reliant after graduating from school, than roaming around looking for white collar jobs. The falling of oil price has presented another opportunity to awaken the giant in Nigeria, and we would not let it pass us by.

Nwobodo Chidiebere writes from Abuja.

chidieberenwobodo@yahoo.com