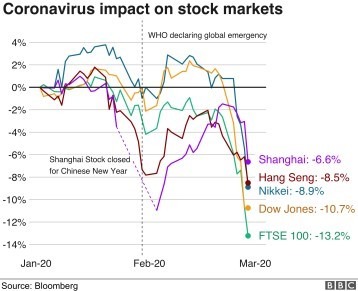

Last year, I wrote an article pertaining to the legacy of Quantitative easing (QE) and low interest rates (IR) on the global economy, focusing particularly on its effect of making unnatural economic environments the norm and how this leaves us badly exposed to a future exogenous shock which could lead us into a recession. Well, this exogenous shock has hit and arrived in the form of the coronavirus. Since its implosion in Europe and America, markets across the world have been hit, with the Dow seeing its worst trading day in percentage terms since ‘black Monday; in 1987 losing 13%[i] of its overall value with billions wiped off the market. Markets in Europe have also been severely hit with the TSE 100 also down 32% from the start of 2020[ii]. The worst has yet to be seen however with a recession awaiting the world once the pandemic is over. What is remarkable, however, is that the economic fallout can be traced back a decade to the policies of central banks and how this crisis has exposed the ineffective policies used by central banks in the last ten years which has weakened the global economy and left us more susceptible the negative economic impacts of Coronavirus.

To understand how coronavirus has exposed the fragile state of our global economy and the incompetence of central banks and governments around the world we must go back to the end of the 2008 financial crisis. In response to the financial crisis, central banks around the world cut interest rates to or near 0% in order to stimulate economic growth. Alongside this, they undertook the unconventional policy which of quantitative easing which is essentially creating new money and pumping it into the economy via the buying of assets and securities in markets to stimulate spending. To put into perspective of how much money was pumped into economies, between 2008 and 2015, $3.7trn was injected by the Fed (USA’s central bank) into the economy. Conversely the Bank of England have injected £375bn between 2009 and 2012. The issue that arose from this was that this was meant to be a short-term policy in reaction to extraordinary circumstances. Very little was known about the long-term effects of QE and crucially, dropping interest rates to unnatural levels was meant to only be a kickstart for the economy as it isn’t a long-term policy. While QE may have ended a few years ago, Interest rates were kept unnaturally low as seen with the UK at 0.25% till last month or in some extreme cases, at negative as seen with the ECB with -0.25%.

What was the issue with Central banks’ policies?

As touched on at the end of the last paragraph, the monetary policies used by central banks across the world were not built for long term use, however, we have seen the continuation of extremely low interest rates (IR) up until now alongside the misuse of QE by central banks. Starting with low IR, the keeping of interest rates unnaturally low can cause markets to become addicted to liquidity as low interest rates provide the enticing incentive of large amounts of cheap cash for firms to have borrowed. While this is fine in the short-term post2008 due to the credit crunch, the continuation of low interest rates has led to companies borrowing more than they could afford (overleveraging). So instead of just kick-starting economic growth, low IR has perpetuated unsustainable debt-fuelled economic growth over the last decade rather than economic growth from natural expansion. This unsustainable debt-fuelled growth can be seen in the increase in corporate debt post-2008 crisis. This can be seen with corporate debt nearing $10 trillion by the end of 2019 – nearly 47% of the US economy[iii]. So, what’s the issue with debt-fuelled growth? (growth fuelled via borrowing). The problem with debt-fuelled growth is that it systematically weakens an economy by making it more vulnerable to an economic slowdown. This means that when an exogenous shock hits an economy (e.g. coronavirus), the negative impact is amplified due to the amount of debt flowing in the economy. This is supported by the IMF who said excessive corporate debt ‘can also amplify shocks, as corporate deleveraging could lead to depressed investment and higher unemployment, and corporate defaults could trigger losses and curb lending by banks’[iv]. Essentially the IMF is saying that during a negative shock (coronavirus) to an economy, excessive amounts of debts can 1) lead to less investment as firms have to spend a higher percentage of their profit on servicing their debts rather than investing (profits fall in a recession). 2) higher unemployment as more firms will default on their unsustainable debt forcing them to shut down and more workers are unemployed. Lastly, having interest rates so low for such a long period limits central banks’ ability to react in a recession. When recessions or slowdowns occur, central banks will lower interest rates to minimise the effects of a recession and stimulate demand and growth in an economy. However, if interest rates are already extremely low, there is little space for central banks to lower it even more, and the amount they can lower it by will be minuscule meaning it will have minimal impact in stimulating growth. Thus, if a negative shock were to hit an economy, central banks will be unable to dampen its effect, leading to a more aggressive recession.

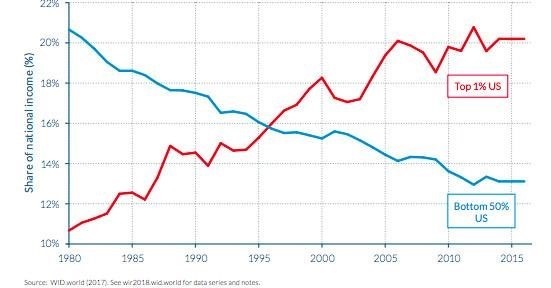

Moving on to QE, the issue with the use of QE by central banks post 2008 financial crisis was that it wasn’t targeted and thus had a counterproductive effect on its initial intention. QE aimed was to stimulate spending and demand in the economy by injecting money into the economy by buying assets in markets. The thinking was that banks who held such assets would now have more money to lend out to consumers and firms who could then spend it thus boosting GDP. However, this was counterproductive as the cash banks made from the selling of their assets to central banks was in fact pocketed and not lent to consumers and firms to stimulate demand and economic growth. Even worse, however, was the unintended impact of increasing inequality. This is because central banks assumed that by buying assets

in markets, banks will have more liquidity, but they did not think of the knock-on effect that buying billions of dollars’ worth of assets will have on the whole market. Basic economics show increased demand for a product will increase the price of it. As wealthy people also held assets alongside banks, the price and value of their assets increased due to the increased demand for them generated by central banks buying them. So, central bank’s plan to stimulate growth actual widened the wealth and income gap as the wealthy were becoming wealthier, while the ordinary person on the street who was unlikely to hold assets was getting poorer.

How have the coronavirus pandemic and central banks’ responses to it exposed central bank policies?

The current coronavirus pandemic has exposed the problems of central bank policies by being the negative shock need to expose the vulnerability of the global economy caused by these policies. I mentioned earlier that the policy of consistently low interest rates has led to debt- fueled growth which makes an economy more vulnerable to an economic slowdown. To

explain this clearly, I’ll walk us through it. The coronavirus pandemic has caused a negative shock to the global economy as normal life has been ground to halt due to lockdown (consumer spending has dropped drastically). This means the majority of businesses face little or no revenue. While this is obviously bad for business anyway, the highly leveraged nature of many firms due to excessive borrowing because of low interest rates mean that some firms won’t survive as they can no longer afford to pay the interest rates on their loans back. What may have just been an issue of firms facing lower profit or small losses has been amplified to a position where debt-riddled firms have been exposed and are forced to close down as they can no longer pay their debts. Another amplification caused by debt-fuelled growth is that a knock-on effect of higher unemployment is caused by defaulting firms closing down and the breakdown of financial markets due to defaults as seen in the last financial crisis. many firms will have This means that an ordinary effect of coronavirus on businesses such as decreased revenue or at worst close down has been amplified with rising debt defaults from excessive borrowing which will lead to events similar to the last financial crisis e.g. credit crunch. Furthermore, central banks’ response to economic fallout caused by Coronavirus has exposed the failings of their policies over the last decade. As mentioned earlier consistently low interest rates create a liquidity trap where central banks can’t lower them anymore or by an amount that has a meaningful impact on dampening the consequences of economic

recession. This has shown by central banks’ responses to the pandemic where they have tried to lower interest rates in order to halt the economic fallout and start a recovery. However, the menial amount they have been reduced by e.g. the UK from 0.25% -> 0.1%, shows the impact of having unnaturally low interest rates. The UK for example only had a 0.25% window to halt the economic fallout and this is a significantly insufficient amount to prevent any crisis. Thus, the impact of the rate cut has been minimal as seen with stock markets continuing to plummet despite the interest rate cuts. Lastly, central banks’ use of QE around the world has shown they haven’t learnt their lesson from their previous use of it in the aftermath of the last recession. The trillions in QE used by central banks around the world may help stabilise markets by providing liquidity, but this will only further widen economic inequality in countries as the value of assets owned by the wealthy will continue to increase as a knock-on effect by the buying of all assets by central banks. Furthermore, in a time where stimulating consumer spending is key to economic recovery, injecting money into an economy via banks who are unwilling to lend or into the hand of the wealthy who own assets instead of the ordinary citizen who is crucial to consumer spending is rather counterproductive.

If we are to come out of this crisis better prepared for the next decade, central banks around the world need to look back at their policies over the last decade and realise how we ended up so susceptible to external shock to ensure we don’t make the same mistakes again. This, however, is easier said than done.

Socials:

Linkedin: Agbolade Oduniyi

Instagram: fosperspectives

- https://www.telegraph.co.uk/business/2020/03/16/markets-live-latest-coronavirusnews-pound-euro-ftse-100-live/

- https://www.telegraph.co.uk/business/2020/03/16/markets-live-latest-coronavirusnews-pound-euro-ftse-100-live/

- https://markets.businessinsider.com/news/stocks/us-corporate-debt-10-trillion-recordpercentage-economy-expert-warnings-2019-12-1028731031#international-monetary-fund1 [iv] https://markets.businessinsider.com/news/stocks/us-corporate-debt-10-trillion-record-

percentage-economy-expert-warnings-2019-12-1028731031#international-monetary-fund1