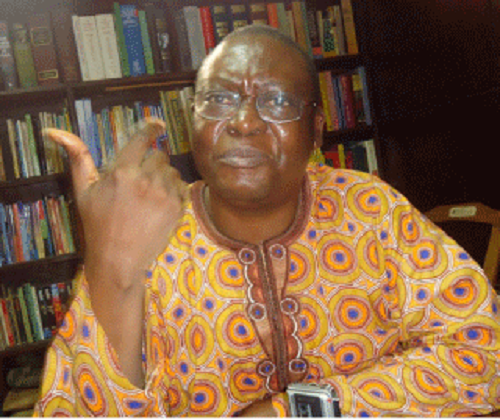

Immediate past Minister of State for Works, Prince Dayo Adeyeye has

threatened to institute legal action against Unity Bank Plc for

publishing his name as a debtor to the bank. He declared that he did

not owe any bank both in Nigeria and anywhere in the world.

Adeyeye, who responded to report in some newspapers today that he was

among those indebted to Unity Bank Plc, said he was only nominated as

a nominal director by the owner of International Payment Devices

Limited, Senator Ayo Arise.

He blamed the banks for the non-performing loans, questioning why they

could grant loans to their clients without taking adequate

collaterals.

The statement read; “Truly, a friend of mine, Senator Ayo Arise, owner

of International Payment Devices Limited, included my name as one of

the directors just to satisfy the Corporate Affairs Commission (CAC)

requirements.

“I have never been part of the operations of the company since it was

incorporated. I have never shared any dividend from the company or

carried out any function on behalf of the company.

“Most importantly, I was never involved in any transaction between the

company and Unity Bank Plc and the bank never informed me that I was

involved in any transaction on behalf of any company.

“The company also did not inform me that it had any financial

obligation or transaction with Unity Bank Plc or any financial

institution until I saw the publication in the newspapers today.

“In the whole world, neither me nor any company that I have interest

in owes any bank or financial institution.

“Besides, it is wrong for any bank to publish names of customers with

which it transact business in newspapers when the court had not

adjudicated and ascertain whether or not the customer actually owed

the bank.

“As a lawyer myself, I know that it is only a competent court of law

that can say whether or not any individual or organisation is a debtor

and it is unethical for a bank to publish names of its clients and

categorise them as debtors when it should have simply taken over the

collaterals used to secure the loan.

“Or is Unity Bank Plc saying that it did not take any collateral

before granting loans as much as N45.52b to the 260 debtors it

released to the press?

“Is it the fault of their clients that they failed to follow due

process in granting loans? If they had followed due process by making

sure that they take collaterals before granting loans, what they

should have done was to take over the properties used as collaterals

for the loans instead of exposing their own incompetence by publishing

names of debtors in newspapers.

“I have therefore instructed my lawyer to institute legal action

against Unity Bank Plc with a view to getting them to pay damages.”