_ABUJA, Nigeria — Tigran Gambaryan, the former head of financial‑crime compliance at Binance who spent nearly eight months in Nigerian detention last year, has publicly mocked the Economic and Financial Crimes Commission (EFCC) for what he calls a “blatant failure” to detect large‑scale fraud. In a Friday social‑media post, Gambaryan wrote, “EFCC couldn’t detect widespread fraud if it came with a name tag and waved at them. Why bother investigating when you can just peddle BS? Billion this, billion that. Give me a break,” directly responding to the agency’s recent allegations that banks, fintech firms and microfinance institutions enabled N18.7 billion in fraudulent transactions by neglecting basic customer due‑diligence ¹.

The EFCC’s January 22 briefing, delivered by its Director of Public Affairs Wilson Uwujaren, detailed a “widespread compromise” of Nigeria’s financial system. Investigators found that a new‑generation commercial bank, six fintech companies and several microfinance banks allowed about N162 billion in cryptocurrency flows and N18.7 billion in fraud proceeds to move without proper Know‑Your‑Customer (KYC) checks. One bank even permitted a single customer to operate 960 accounts, all used for illicit activity, while another facilitated the conversion of stolen funds into digital assets and their transfer overseas ²[5].

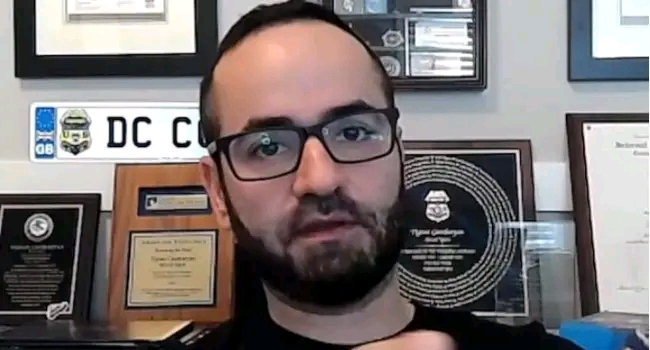

Gambaryan’s remarks come on the heels of his own turbulent history with the EFCC. Arrested in February 2024 after a crackdown on Binance over alleged currency manipulation, he was later charged with money‑laundering alongside the exchange. After a series of health‑related bail denials and a high‑profile collapse in court, the EFCC dropped its case against him in October 2024, citing “critical international and diplomatic reasons” ¹. His eight‑month detention, which he described as “solitary confinement, malnutrition and lack of medical care,” has fueled his scathing critique of the agency’s investigative capacity [4].

The anti‑graft body has defended its record, noting that it has recovered N33.6 million for victims and urging regulators to suspend any institution found aiding fraudsters. Uwujaren warned that “negligence and failure to monitor suspicious transactions will no longer be tolerated,” and called for strict enforcement of KYC, Customer Due Diligence (CDD) and Suspicious Transaction Reporting (STR) rules ²[5].

Financial analysts say Gambaryan’s outburst reflects growing frustration within the fintech sector over perceived regulatory overreach and inefficiency. “When a former compliance chief publicly doubts the watchdog’s competence, it signals a credibility gap that could undermine confidence in Nigeria’s rapidly digitalising financial ecosystem,” said Lagos‑based risk consultant Aisha Bello.

As the EFCC promises tougher sanctions and the Central Bank of Nigeria reviews its oversight framework, stakeholders await concrete actions that will translate regulatory rhetoric into effective fraud prevention. Meanwhile, Gambaryan’s pointed commentary has thrust the debate over Nigeria’s anti‑money‑laundering effectiveness into the national spotlight, leaving both regulators and industry players under intense public scrutiny.