The Nigerian National Petroleum Corporation (NNPC) has expressed its readiness to strategically put in place measures that would alleviate the cost of crude oil production in Nigeria to create market for Nigeria’s crude and make Nigeria a choice destination for Foreign Direct Investment.

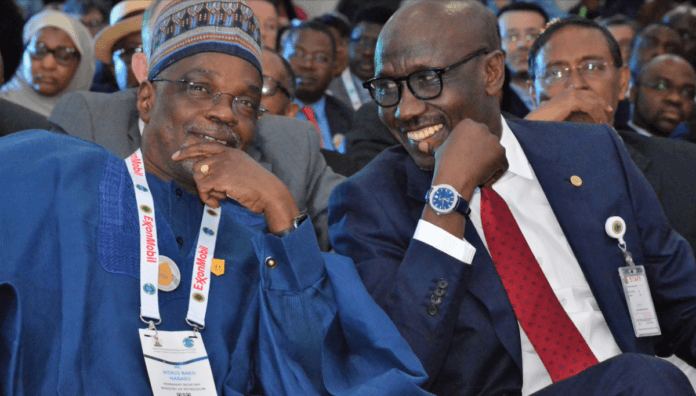

Group Managing Director of the NNPC, Mallam Mele Kyari, made this known at the Central Bank of Nigeria Round Table discussion in Abuja Wednesday.

Mallam Kyari stated that at the moment the cost of crude oil production in the country was within the range of $15 to $17 per barrel, adding that some leaders in the Industry such as Saudi Arabia’s cost of production is between $4 and $5 per barrel.

He noted that due to the uncertainties of the global crude oil market, countries that produce at the cheapest price would remain in the market while jurisdiction with high cost of crude oil production would not be able to cope with the competing prices.

He noted that due to the Coronavirus pandemic, Nigeria has about 50 cargoes of crude oil that have not found landing, adding that this implies that there are no off-takers for them for now due to drop in demand.

“Today, I can share with you that there are over 12 stranded LNG cargoes in the market globally. It has never happened before. LNG cargoes that are stranded with no hope of being purchased because there is abrupt collapse in demand associated with the outbreak of coronavirus,” Mallam Kyari submitted.

He said that in the face of the Coronavirus global pandemic, countries like Saudi Arabia have given discount of $8 and Iraq $5 to their off-takers in some locations meaning that when crude oil sells at $30 per barrel, countries like Saudi Arabia is selling at $22 per barrel and Iraq selling their crude at $25 per barrel.

The GMD said the NNPC was working round the clock to increase the countries daily production to 3million barrels per day and shore up the crude oil reserves to 40billion barrels.

Mallam Kyari called on government at all levels, captains of Industries and the organized private sectors to brace up for the new low regime of global crude oil prices, adding that realistic estimates must be made to reflect the current realities of the crude oil market.