Ekiti Govt Debunks Claim That Fayose Borrowed N56bn

…says; “Govt took N10bn ECA grant, N1bn loan for SUBEB counterpart fund”

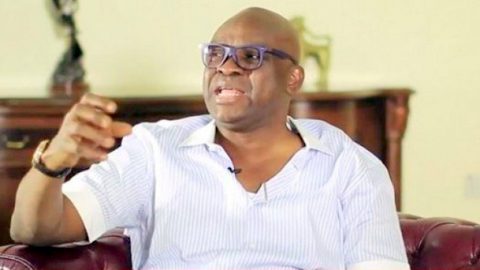

Ekiti State Government has described as total falsehood, report that

the State borrowed a total sum of N56 billion since Governor Ayodele

Fayose assumed office and that a fresh N25 billion loan was applied

for; saying that; “the only fresh loan taken by the government of

Fayose was the N10 billion grant from the Excess Crude Account, which

was released to all States for capital projects, N2.8 billion

requested from Wema Bank to pay State Universal Basic Education Board

(SUBEB) counterpart fund out of which N1 billion has been accessed and

N600 million for MDGs counterpart fund, which has been repaid.”

The government said “the report, which was attributed to the Debt

Management Office (DMO) was orchestrated from the media office of the

Minister of Mines and Steel Development, Dr Kayode Fayemi, who is

obviously struggling albeit unsuccessfully to redeem his battered

image by trying to change the narrative from the debt he plunged Ekiti

State to and the wanton looting of the treasury when he was governor.

We are aware of how hard Fayemi’s media handlers tried yesterday, to

get the false report published in major newspapers, claiming that they

had a classified document from the DMO.”

Special Assistant to the State Governor on Public Communications and

New Media, Lere Olayinka, who reacted to the report in a release

issued on Monday, said; “There is no recent bulletin from the DMO

website concerning debt owed by any state as claimed in the false

report. Nigerians, especially Ekiti people can visit the DMO website:

https://www.dmo.gov.ng/debt-profile/domestic-debts for further

clarification.”

He said; “As at the time Governor Fayose assumed office, some of the

loans on the debt profile of Ekiti State were; Bond from capital

market (N26.7 billion), loan for developmental projects obtained from

Ecobank using Fountain Holdings (N5 billion), loan for

recapitalization obtained from Wema Bank (N1 billion), commercial

agric credit scheme from First Bank (N420.8 million), loan for legacy

facility obtained from Ecobank (N408.2m), loan for developmental

projects obtained from Skye Bank (N7.5bn), vehicle lease obtained from

Ecobank (N146.6bn), laptop procurement (N375m) among others.”

“It is on record that Ekiti State Government was indebted to the tune

of N86, 013,689,097 as at October 16, 2014 that Governor Fayose took

over. The debts are broken down as follows: Bank Loans; N15,

831,613,425.62, Bond; N26, 749,796,784.75, Outstanding Warrants; N15,

522,552,900.76, Outstanding to Road Contractors; N21, 286,126,749,

Outstanding Remittances to FG; N709, 883,656.75, Outstanding

Remittances (State Govt); N592, 995,374.89 and EKSG Public Servants

Outstanding Emoluments; N5, 137,888,224.37.

“We are however not unmindful of the battered image of the APC in

Ekiti State and the attempt to change the narrative to ‘Fayemi’s

government truly plunged Ekiti into debt, but Fayose’s government has

borrowed more.’ This is more like someone admitting to being a thief

but calling others thieves too.

“No matter how hard Fayemi and his spin-doctors try, they cannot erase

the fact that apart from regular monthly allocation and Subsidy

Reinvestment Programme (SURE-P) fund among others, Fayemi’s received

N46.4 billion from the Excess Crude Account, yet he took N25 billion

bond and N31 billion commercial bank loan. One of such frivolous loans

was the N5 billion obtained from Ecobank without the DMO approval,

using Fountain Holdings Limited, a company with N15 million share

capital.

“Finally, the website of the DMO is www.dmo.gov.ng, Nigerians can

visit the website to see whether or not there was any bulletin

published this month concerning debt owed by Ekiti State government.”